The 'Repeater Tax' Is Going To Transform The NBA

2 posters

Page 1 of 1

The 'Repeater Tax' Is Going To Transform The NBA

The 'Repeater Tax' Is Going To Transform The NBA

http://www.sbnation.com/2013/11/21/5126774/nba-luxury-tax-2013-repeater-chicago-bulls

The repeater tax is going to transform the NBA

By Mark Deeks on Nov 21 2013, 2:52p 39

Next summer brings the repeater tax, which will levy additional penalties on teams that have payrolls above the luxury-tax threshold for multiple years. We explain how this will make it extremely difficult to keep good teams together.

Next season, the repeater tax, which penalizes teams for being over the luxury tax for multiple seasons, comes into force. It is thought to be one of the toothiest new pieces of apparatus for revenue sharing and attempted market equality that the 2011 CBA has to offer. How toothy will it be?

Potentially, very.

The first challenge any franchise has is to build a good team. The second challenge is to keep it good. The first challenge is hard enough that about 20 franchises fail at it every season. The repeater tax is a direct and emphatic attack upon the second.

Under the first two seasons of this CBA, the luxury tax rates stayed the same as they were under the previous one. Teams paid $1 for every dollar they were over the luxury-tax threshold, and there was no repeater tax in force. As of this year, the rates of tax have changed, depending on how far over you are. These incremental ranges go from a $1.50/$1 dollar ratio from teams up to $5 million over, up to $3.75-$1 for teams between $20-$25 million over and increasing by an extra $.50 for every extra $5 million over that.

These rates are incremental. If you are $25 million over the tax, you don't pay $3.75 for every dollar you are over the tax, but instead only for every dollar more than $25 million over the tax, plus the appropriate rates for all increments up to that one. Confusing though it may be, the point is apparent: Teams considerably over the tax are going to really, really pay for it.

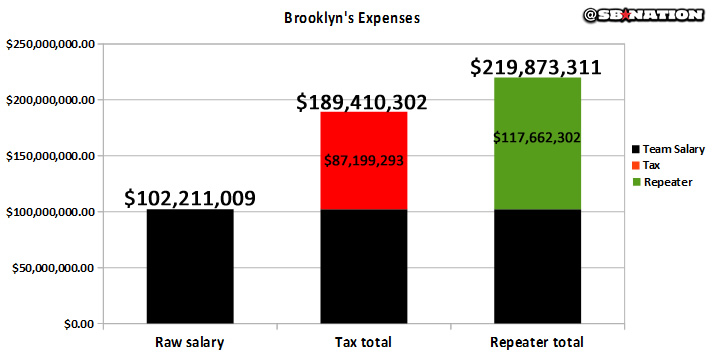

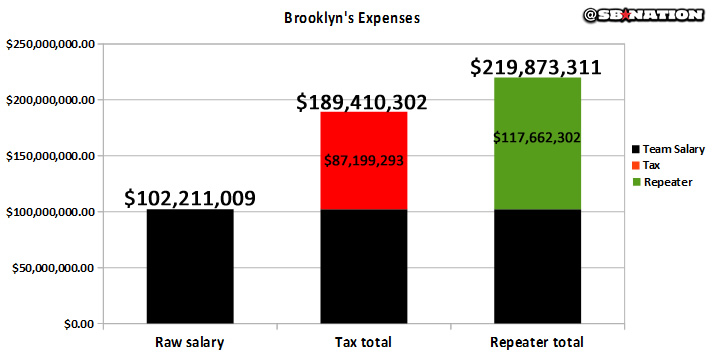

Brooklyn's tax problem

How the repeater tax would empty more money out of Mikhail Prokhorov's pocket.

And as of next season, this will be even further true. Teams susceptible to the repeater tax get $1 extra added to each dollar of tax that they would otherwise pay. The aforementioned incremental ratios therefore would become $2.50/$1 for teams up to $5 million over and up to $4.75-$1 for teams between $20-$25 million over. (See the full calculations at the bottom of this piece.)

To put those numbers in a real context, we can use that most obvious example: the Brooklyn Nets and their tax number this season of $102,211,009 against a tax threshold of $71,748,000. Using the 2012-13 tax rates, they would have paid $102,211,009 in salary and $30,463,009 in luxury tax for a total expenditure of $132,674,018. Using this season's tax rates, though, they are due to pay the $102,211,009 in salary, but pay the tax at the various incremental rates. After some maths, this means a total tax bill of $87,199,293, for a total player payroll expenditure of $189,410,302.

As for the important part here, the same payroll and the same threshold with the repeater tax invoked would hypothetically mean a total tax bill of $117,662,302 in 2013-14, for a total player payroll expenditure of $219,873,311. This is astronomical and far in excess of Brooklyn's actual revenue. There is a reason Brooklyn is paying all that tax this season and not next: This year, the Nets aren't paying the repeater. The amount of tax they are already due to pay is outlandish. The repeater would push it into the ridiculous.

The above is a load of numbers, confusing ones at that. But the practical implications of it are more pertinent. How, exactly, do these numbers stop good teams from staying good?

***

A look at a different team, the Chicago Bulls, might help to demonstrate this.

Next year, the repeater tax will be levied upon any team to have paid luxury tax in all of the three previous seasons. The only three teams to have paid tax in both seasons of the new CBA thus far are the Lakers, Heat and Celtics, only the first two of whom are due to do so again. However, from 2015-16 onward, repeater tax will be charged to any team paying in three of the previous four seasons, including the season in question. That is what threatens Chicago.

In 2012-13, Chicago paid the luxury tax for the first time in franchise history. The Bulls did not have to, but they did so because Derrick Rose's injury made the signing of Kirk Hinrich so important that they felt it worthy of paying tax. Furthermore, while they could have gotten out from under the tax at the trade deadline, they chose not to, as it would have meant relinquishing a first-round pick. That is how much they valued the first-round pick. (On a slight tangent, it makes their subsequent attempts to trade Marquis Teague for a first-rounder look even more ambitious.)

Chicago is due to pay luxury tax again this season. The Bulls are currently $7,540,428 over the threshold and are not likely at all to get under it. This, then, puts them in line for the repeater rates should they pay luxury tax again in either of the next two seasons.

The Bulls' projected total expenditure this season after tax is due to be $91,234,177. The same payroll with the same hypothetical tax threshold, when subject to repeater tax, would result in a total expenditure of $98,774,605. This again demonstrates the effectiveness of the repeater tax. A team now only a mere few million over the luxury tax, then, is starting to get incredibly expensive, to the point that being one good player over the threshold puts it at a near nine-figure payroll. (Imagine if Chicago had Omer Asik's $14.8 million to contend with next season, too. Add that in and run the same numbers. Chicago did. And that is why the Bulls let him walk.)

The Bulls could potentially pay this nearly nine-figure repeater tax amount. Even if they often do not spend as such, they are a big-market, high-revenue team. A smaller-market team, however, could not. Given its self-imposed payroll restrictions, Chicago likely cannot either.

CHICAGO CANNOT KEEP ITS CURRENT TEAM TOGETHER WITHOUT PAYING THE REPEATER TAX

So what can the Bulls do? Trading Taj Gibson to another team for no returning salary would get them under the luxury tax this season. Doing so would save them roughly $20 million this year alone, plus $25.45 million in the future salary owed to him and an incalculable amount potentially saved in repeater tax. Without saying the Bulls will do this -- there is no evidence of that -- or that they should do it -- they shouldn't -- Gibson is nonetheless used as an example here to demonstrate the effectiveness of the new punitive luxury tax penalties, and in particular, the repeater tax. The threat of the repeater tax will inevitably force Chicago to lose a quality piece of its team. Be it Gibson, Carlos Boozer (logical amnesty candidate) or Luol Deng (expensive unrestricted free agent), finances will demand that someone leaves.

Realistically, Chicago cannot keep its current team together without paying the repeater tax. Unless the Bulls allow Deng to walk, or amnesty Boozer, they will not be able to avoid luxury tax next season, thereby triggering the repeater. And as we've seen, any repeater tax paid will be prohibitively expensive.

The toughened tax penalties, then, are seen here to weaken a competitive team. It simply cannot keep it together. It will have to rebuild somewhat to keep it good, to meet that second challenge.

***

We will witness in the two coming seasons that stiffening up the tax penalties will break the monotony of teams spending far in excess of the tax repeatedly, and will continue to prevent many teams from going over it at all. If there is going to be an exception, it will be Brooklyn, but even the Nets will feel a distinct pinch.

In the long run, this makes the prioritization of youth and cheap basketball assets an ever greater priority than before. This, ultimately, is how good teams will remain good. Good teams cannot, unless they are blessed with ridiculously rich owners unfazed by significant operating losses (much more significant than ever before), just pay the price to stay together anymore.

In this regard, Chicago is blessed. The Bulls retain the cheap services of Jimmy Butler, are still owed a potentially lucrative first-round pick from Charlotte and have top European prospect Nikola Mirotic waiting in the wings. When Chicago inevitably loses veteran talent due to financial constraints, it has genuine talent and quality assets with which to replace them. This will allow the Bulls to have a sustained run at success, to stay good and to fire more than one bullet at winning a title. The repeater tax being what it is may break up the current team, but new blood can come in and push it back to competitiveness, so as to not waste Rose's still-distant prime years.

Good for the Bulls. But what about the competitive teams not so prepped for the future? How will they stay good? Where, for example, are Indiana's future pieces to sustain its window after 2015, when the payroll crunch kicks in and much of the talent starts to decline or leave? What will Miami do after these next couple of seasons? When Donald Sterling is introduced to the repeater tax, what will it mean for the Clippers? Is it worth going all-in now, in Chris Paul's prime, even if it means jeopardizing Blake Griffin's later on because they cannot pay significant tax too many years in a row? This being the Clippers, can they even pay much at all?

IT'S NOT THIS YEAR. IT'S THE NEXT THREE.

These are the problems the tougher tax penalties will cause. It's not this year. It's the next three.

The teams mentioned above may not have had much choice in pursuing the strategies they have. And in Miami's case, it is of course ridiculous to fault it given the titles it has brought. But with the new CBA has come this new problem, and several teams are about to get stark reminders of it. Including the Clippers, who absolutely cannot pay luxury tax this season.

As of right now, they are due to. For the sake of Blake's career, this needs to change. For the first time, perhaps ever, the Clippers will be justified in being cheap.

NORMAL TAX RATES

Increment:----------------Taxed at:---------- Incremental total:-----------Running total:

$0-$4,999,999 over--------$1.50 - $1----------$7.5 million-----------------$7.5 million

$5 million - $9,999,999-----$1.75 - $1----------$8.75 million----------------$16.25 million

$10 million - $14,999,999---$2.50 - $1----------$12.5 million----------------$28.75 million

$15 million - $19,999,999---$3.25 - $1----------$16.25 million---------------$45 million

$20 million - $24,999,999---$3.75 - $1----------$18.75 million---------------$63.75 million

$25 million - $29,999,999---$4.25 - $1----------$21.25 million---------------$85 million

$30 million - $30,463,009---$4.75 - $1----------$2,199,720-------------------$87,219,720

REPEATER TAX RATES

Increment:-----------------Taxed at:------------Incremental total:-------------Running total:

$0-$4,999,999 over---------$2.50 - $1-----------$12.5 million-------------------$12.5 million

$5 million - $9,999,999------$2.75 - $1-----------$13.75 million------------------$26.25 million

$10 million - $14,999,999----$3.50 - $1-----------$17.5 million-------------------$43.75 million

$15 million - $19,999,999----$4.25 - $1-----------$21.25 million------------------$65 million

$20 million - $24,999,999----$4.75 - $1-----------$23.75 million------------------$88.75 million

$25 million - $29,999,999----$5.25 - $1-----------$26.25 million------------------$115 million

$30 million - $30,463,009----$5.75 - $1-----------$2,662,302----------------------$117,662,302

bob

MY NOTE: There is something wrong with the final numbers on the normal and repeater tax chart. Without working a calculator, it must be $26.662M and not $2.6M on the repeater tax chart and a corresponding adjustment on the normal tax chart. Another assumption of this article is that Mikhail Prokhorov and The Buss Family Trust give a damn about this. Prokhorov's eyes are on a bigger prize, the Premiership of Russia, and the Buss family knows that as long as they field a competitive team the cable TV and other revenues will cover losses. There will certainly be some transformative effect on the NBA by the Repeater Tax. We've all heard Danny say, outright, that we will stay under the cap this year, and Wyc's not exactly shy about spending money. Imagine how the owner of a smaller market team feels.

.

The repeater tax is going to transform the NBA

By Mark Deeks on Nov 21 2013, 2:52p 39

Next summer brings the repeater tax, which will levy additional penalties on teams that have payrolls above the luxury-tax threshold for multiple years. We explain how this will make it extremely difficult to keep good teams together.

Next season, the repeater tax, which penalizes teams for being over the luxury tax for multiple seasons, comes into force. It is thought to be one of the toothiest new pieces of apparatus for revenue sharing and attempted market equality that the 2011 CBA has to offer. How toothy will it be?

Potentially, very.

The first challenge any franchise has is to build a good team. The second challenge is to keep it good. The first challenge is hard enough that about 20 franchises fail at it every season. The repeater tax is a direct and emphatic attack upon the second.

Under the first two seasons of this CBA, the luxury tax rates stayed the same as they were under the previous one. Teams paid $1 for every dollar they were over the luxury-tax threshold, and there was no repeater tax in force. As of this year, the rates of tax have changed, depending on how far over you are. These incremental ranges go from a $1.50/$1 dollar ratio from teams up to $5 million over, up to $3.75-$1 for teams between $20-$25 million over and increasing by an extra $.50 for every extra $5 million over that.

These rates are incremental. If you are $25 million over the tax, you don't pay $3.75 for every dollar you are over the tax, but instead only for every dollar more than $25 million over the tax, plus the appropriate rates for all increments up to that one. Confusing though it may be, the point is apparent: Teams considerably over the tax are going to really, really pay for it.

Brooklyn's tax problem

How the repeater tax would empty more money out of Mikhail Prokhorov's pocket.

And as of next season, this will be even further true. Teams susceptible to the repeater tax get $1 extra added to each dollar of tax that they would otherwise pay. The aforementioned incremental ratios therefore would become $2.50/$1 for teams up to $5 million over and up to $4.75-$1 for teams between $20-$25 million over. (See the full calculations at the bottom of this piece.)

To put those numbers in a real context, we can use that most obvious example: the Brooklyn Nets and their tax number this season of $102,211,009 against a tax threshold of $71,748,000. Using the 2012-13 tax rates, they would have paid $102,211,009 in salary and $30,463,009 in luxury tax for a total expenditure of $132,674,018. Using this season's tax rates, though, they are due to pay the $102,211,009 in salary, but pay the tax at the various incremental rates. After some maths, this means a total tax bill of $87,199,293, for a total player payroll expenditure of $189,410,302.

As for the important part here, the same payroll and the same threshold with the repeater tax invoked would hypothetically mean a total tax bill of $117,662,302 in 2013-14, for a total player payroll expenditure of $219,873,311. This is astronomical and far in excess of Brooklyn's actual revenue. There is a reason Brooklyn is paying all that tax this season and not next: This year, the Nets aren't paying the repeater. The amount of tax they are already due to pay is outlandish. The repeater would push it into the ridiculous.

The above is a load of numbers, confusing ones at that. But the practical implications of it are more pertinent. How, exactly, do these numbers stop good teams from staying good?

***

A look at a different team, the Chicago Bulls, might help to demonstrate this.

Next year, the repeater tax will be levied upon any team to have paid luxury tax in all of the three previous seasons. The only three teams to have paid tax in both seasons of the new CBA thus far are the Lakers, Heat and Celtics, only the first two of whom are due to do so again. However, from 2015-16 onward, repeater tax will be charged to any team paying in three of the previous four seasons, including the season in question. That is what threatens Chicago.

In 2012-13, Chicago paid the luxury tax for the first time in franchise history. The Bulls did not have to, but they did so because Derrick Rose's injury made the signing of Kirk Hinrich so important that they felt it worthy of paying tax. Furthermore, while they could have gotten out from under the tax at the trade deadline, they chose not to, as it would have meant relinquishing a first-round pick. That is how much they valued the first-round pick. (On a slight tangent, it makes their subsequent attempts to trade Marquis Teague for a first-rounder look even more ambitious.)

Chicago is due to pay luxury tax again this season. The Bulls are currently $7,540,428 over the threshold and are not likely at all to get under it. This, then, puts them in line for the repeater rates should they pay luxury tax again in either of the next two seasons.

The Bulls' projected total expenditure this season after tax is due to be $91,234,177. The same payroll with the same hypothetical tax threshold, when subject to repeater tax, would result in a total expenditure of $98,774,605. This again demonstrates the effectiveness of the repeater tax. A team now only a mere few million over the luxury tax, then, is starting to get incredibly expensive, to the point that being one good player over the threshold puts it at a near nine-figure payroll. (Imagine if Chicago had Omer Asik's $14.8 million to contend with next season, too. Add that in and run the same numbers. Chicago did. And that is why the Bulls let him walk.)

The Bulls could potentially pay this nearly nine-figure repeater tax amount. Even if they often do not spend as such, they are a big-market, high-revenue team. A smaller-market team, however, could not. Given its self-imposed payroll restrictions, Chicago likely cannot either.

CHICAGO CANNOT KEEP ITS CURRENT TEAM TOGETHER WITHOUT PAYING THE REPEATER TAX

So what can the Bulls do? Trading Taj Gibson to another team for no returning salary would get them under the luxury tax this season. Doing so would save them roughly $20 million this year alone, plus $25.45 million in the future salary owed to him and an incalculable amount potentially saved in repeater tax. Without saying the Bulls will do this -- there is no evidence of that -- or that they should do it -- they shouldn't -- Gibson is nonetheless used as an example here to demonstrate the effectiveness of the new punitive luxury tax penalties, and in particular, the repeater tax. The threat of the repeater tax will inevitably force Chicago to lose a quality piece of its team. Be it Gibson, Carlos Boozer (logical amnesty candidate) or Luol Deng (expensive unrestricted free agent), finances will demand that someone leaves.

Realistically, Chicago cannot keep its current team together without paying the repeater tax. Unless the Bulls allow Deng to walk, or amnesty Boozer, they will not be able to avoid luxury tax next season, thereby triggering the repeater. And as we've seen, any repeater tax paid will be prohibitively expensive.

The toughened tax penalties, then, are seen here to weaken a competitive team. It simply cannot keep it together. It will have to rebuild somewhat to keep it good, to meet that second challenge.

***

We will witness in the two coming seasons that stiffening up the tax penalties will break the monotony of teams spending far in excess of the tax repeatedly, and will continue to prevent many teams from going over it at all. If there is going to be an exception, it will be Brooklyn, but even the Nets will feel a distinct pinch.

In the long run, this makes the prioritization of youth and cheap basketball assets an ever greater priority than before. This, ultimately, is how good teams will remain good. Good teams cannot, unless they are blessed with ridiculously rich owners unfazed by significant operating losses (much more significant than ever before), just pay the price to stay together anymore.

In this regard, Chicago is blessed. The Bulls retain the cheap services of Jimmy Butler, are still owed a potentially lucrative first-round pick from Charlotte and have top European prospect Nikola Mirotic waiting in the wings. When Chicago inevitably loses veteran talent due to financial constraints, it has genuine talent and quality assets with which to replace them. This will allow the Bulls to have a sustained run at success, to stay good and to fire more than one bullet at winning a title. The repeater tax being what it is may break up the current team, but new blood can come in and push it back to competitiveness, so as to not waste Rose's still-distant prime years.

Good for the Bulls. But what about the competitive teams not so prepped for the future? How will they stay good? Where, for example, are Indiana's future pieces to sustain its window after 2015, when the payroll crunch kicks in and much of the talent starts to decline or leave? What will Miami do after these next couple of seasons? When Donald Sterling is introduced to the repeater tax, what will it mean for the Clippers? Is it worth going all-in now, in Chris Paul's prime, even if it means jeopardizing Blake Griffin's later on because they cannot pay significant tax too many years in a row? This being the Clippers, can they even pay much at all?

IT'S NOT THIS YEAR. IT'S THE NEXT THREE.

These are the problems the tougher tax penalties will cause. It's not this year. It's the next three.

The teams mentioned above may not have had much choice in pursuing the strategies they have. And in Miami's case, it is of course ridiculous to fault it given the titles it has brought. But with the new CBA has come this new problem, and several teams are about to get stark reminders of it. Including the Clippers, who absolutely cannot pay luxury tax this season.

As of right now, they are due to. For the sake of Blake's career, this needs to change. For the first time, perhaps ever, the Clippers will be justified in being cheap.

NORMAL TAX RATES

Increment:----------------Taxed at:---------- Incremental total:-----------Running total:

$0-$4,999,999 over--------$1.50 - $1----------$7.5 million-----------------$7.5 million

$5 million - $9,999,999-----$1.75 - $1----------$8.75 million----------------$16.25 million

$10 million - $14,999,999---$2.50 - $1----------$12.5 million----------------$28.75 million

$15 million - $19,999,999---$3.25 - $1----------$16.25 million---------------$45 million

$20 million - $24,999,999---$3.75 - $1----------$18.75 million---------------$63.75 million

$25 million - $29,999,999---$4.25 - $1----------$21.25 million---------------$85 million

$30 million - $30,463,009---$4.75 - $1----------$2,199,720-------------------$87,219,720

REPEATER TAX RATES

Increment:-----------------Taxed at:------------Incremental total:-------------Running total:

$0-$4,999,999 over---------$2.50 - $1-----------$12.5 million-------------------$12.5 million

$5 million - $9,999,999------$2.75 - $1-----------$13.75 million------------------$26.25 million

$10 million - $14,999,999----$3.50 - $1-----------$17.5 million-------------------$43.75 million

$15 million - $19,999,999----$4.25 - $1-----------$21.25 million------------------$65 million

$20 million - $24,999,999----$4.75 - $1-----------$23.75 million------------------$88.75 million

$25 million - $29,999,999----$5.25 - $1-----------$26.25 million------------------$115 million

$30 million - $30,463,009----$5.75 - $1-----------$2,662,302----------------------$117,662,302

bob

MY NOTE: There is something wrong with the final numbers on the normal and repeater tax chart. Without working a calculator, it must be $26.662M and not $2.6M on the repeater tax chart and a corresponding adjustment on the normal tax chart. Another assumption of this article is that Mikhail Prokhorov and The Buss Family Trust give a damn about this. Prokhorov's eyes are on a bigger prize, the Premiership of Russia, and the Buss family knows that as long as they field a competitive team the cable TV and other revenues will cover losses. There will certainly be some transformative effect on the NBA by the Repeater Tax. We've all heard Danny say, outright, that we will stay under the cap this year, and Wyc's not exactly shy about spending money. Imagine how the owner of a smaller market team feels.

.

bobheckler- Posts : 62620

Join date : 2009-10-28

Re: The 'Repeater Tax' Is Going To Transform The NBA

Re: The 'Repeater Tax' Is Going To Transform The NBA

OKC and Memphis caught a sniff of this and ran. But in doing so, they sacrificed key players that could've contributed to those respective teams winning a title. As constructed, neither team can win in the West.

Miami is probably the most interesting team to observe when it comes to this tax. Wade, James, and Bosh are all set to make $22M/yr next year. Miami's sunken a majority of their cap room in 3 players. That team is running on a short window.

In the end, I think it'd be impossible for any one team to win a title without exceeding the cap and the luxury threshold as well. Ainge understands this and already understands how the repeater tax works. Theoretically, Boston could exceed the luxury tax for a couple years and then go back under it to avoid the repeater penalty. Of course, this means Boston would have to avoid signing too many long term contracts to ensure this. And I'm sure other teams will utilize this as well.

KJ

Miami is probably the most interesting team to observe when it comes to this tax. Wade, James, and Bosh are all set to make $22M/yr next year. Miami's sunken a majority of their cap room in 3 players. That team is running on a short window.

In the end, I think it'd be impossible for any one team to win a title without exceeding the cap and the luxury threshold as well. Ainge understands this and already understands how the repeater tax works. Theoretically, Boston could exceed the luxury tax for a couple years and then go back under it to avoid the repeater penalty. Of course, this means Boston would have to avoid signing too many long term contracts to ensure this. And I'm sure other teams will utilize this as well.

KJ

k_j_88- Posts : 4748

Join date : 2013-01-06

Age : 35

Similar topics

Similar topics» Sully Hopes to Transform Body like Kevin Love

» The Boston Celtics Newest Additions Will Help Transform Their Offense

» The Boston Celtics Newest Additions Will Help Transform Their Offense

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum